Biden Pardons Hunter, Global Tensions Rise with Iran, VW Strikes, and Trump’s Dollar Remarks

Today’s key developments include Biden’s controversial pardon of Hunter Biden, China’s uncertain economic outlook amid Politburo disruptions, Germany’s rising tensions over Chinese drones and trade, Iran’s oil trade challenges under US sanctions, and VW workers’ walkouts over cost-cutting measures.

Good morning! It’s Ryosuke. Today’s key developments include Biden’s controversial pardon of Hunter Biden, China’s uncertain economic outlook amid Politburo disruptions, Germany’s rising tensions over Chinese drones and trade, Iran’s oil trade challenges under US sanctions, and VW workers’ walkouts over cost-cutting measures.

Biden Pardons Son Hunter in Reversal With Weeks Left in Term

Photo by Bohdan Komarivskyi / Unsplash

Biden Grants Pardon Amid Controversy: In a surprising turn, President Joe Biden has signed a sweeping pardon for his son, Hunter Biden, reversing previous statements that he would not intervene. Biden justified the pardon by claiming Hunter was politically targeted, stating that the charges were initiated by political opponents to undermine his administration.

Political Ramifications and Criticism: The pardon, issued just weeks before Biden's term ends, has sparked backlash, particularly from Republican lawmakers. Former President Trump criticized the decision, highlighting the contrast with his own pardons and questioning Biden's motivations. The pardon covers Hunter’s past legal troubles, including gun and tax charges.

Hunter’s Legal Woes and Family Impact: Hunter Biden has faced significant legal challenges, including federal charges that threatened long prison sentences. Despite these, the pardon eliminates potential future legal consequences for actions committed between 2014 and 2024. Hunter has expressed remorse, stating his commitment to using his second chance for good.

Republican Reactions and Continued Investigations: The pardon has intensified partisan divides. While Hunter Biden’s legal troubles have shadowed the President’s campaign, Republicans continue investigations into his business dealings. However, no solid evidence has been found linking the President to his son's actions. The pardon’s timing raises questions about potential political motivations.

China Skips Politburo Readout as Investors Await Stimulus

Photo by Ralf Leineweber / Unsplash

Politburo’s Absence Fuels Uncertainty: The Chinese Communist Party’s elite decision-making body, the Politburo, skipped its regular November meeting readout, the first time since May 2023. This disruption, along with delays in other major meetings, signals ongoing shifts in China’s political calendar. Investors are now focusing on two crucial economic meetings this month, anticipating stronger stimulus measures.

Investor Focus on Upcoming Meetings: With Beijing under pressure to stimulate growth, particularly as it faces threats of higher tariffs from the incoming U.S. administration, investors are hoping that the upcoming December sessions will announce substantial fiscal and monetary policy measures. These meetings typically shape China’s economic direction for the coming year, including potential adjustments to deficit targets and policy priorities.

Expectations for Monetary Easing Grow: Following recent bond market developments, where China’s 10-year government bond yield dropped below 2%, there is rising speculation of further monetary easing. The government has already implemented measures like rate cuts and financial support for local governments, with another reserve requirement reduction expected soon.

Mixed Outcomes from Past Conferences: Investors remain cautious after last year’s disappointing December conference, where minimal stimulus was announced. Despite hopes for bold moves, previous meetings have seen a focus on industrial policy rather than economic stimulus. This year, with continuing economic struggles, investors are looking for stronger signals of action from the Chinese leadership.

German Foreign Minister Says Chinese-Made Drones Hurting Europe

Photo by Karl Greif / Unsplash

Criticism of Chinese Drones and Russia's War Effort: German Foreign Minister Annalena Baerbock has sharply criticized China, claiming that Chinese-made drones used by Russia in its war against Ukraine are damaging Europe’s security. While Baerbock did not provide direct evidence during her public statements, the comments align with growing concerns within the EU over China’s role in supporting Russia’s military efforts.

EU Sanctions on Chinese Firms Loom: As part of the EU's crackdown on countries aiding Russia, Baerbock’s remarks come ahead of potential sanctions on Chinese companies allegedly involved in developing attack drones for Russia. Around 60% of Russian war materials reportedly contain Chinese components, with nearly 20% of its fighter drones relying on Chinese-made parts.

Tensions Between Germany and China Over Trade: Baerbock’s visit to China also coincides with ongoing trade tensions, particularly over Chinese electric vehicles, which the EU believes benefit from unfair state subsidies. While Germany’s Chancellor Olaf Scholz has refrained from imposing tariffs due to concerns over retaliation against German exports, Baerbock has emphasized Germany’s commitment to international trade rules.

Political Goals Amid Diplomatic Strain: Critics argue that Baerbock’s comments reflect a more politically-driven visit than one aimed at mending ties between Berlin and Beijing. As Germany grapples with security and trade concerns, there is increasing pressure to address China’s influence in global geopolitics.

Iran’s Oil Trade With China Rattled by US Sanctions on Tankers

Photo by Thais Morais / Unsplash

Sanctions Disrupt Iranian Crude Deliveries: U.S. sanctions on tankers transporting Iranian oil have significantly slowed the flow of crude to China, Tehran’s primary customer. These sanctions, which have targeted vessels involved in the trade, have forced operators to abandon their previous routes, leading to a reduction in the number of available tankers for transporting Iranian oil.

Shift in Tanker Operations and Rising Costs: In response to the sanctions, many tankers are changing flags or routes to avoid detection, as seen with the tanker Shanaye Queen, which recently switched to a Guyanese flag. This shift has led to fewer tankers available for transporting oil from Iran to China, driving up the cost of Iranian crude and prompting Chinese refiners to seek alternative supplies from Africa and the Middle East.

Impact on Chinese Refiners: Independent Chinese refiners, which handle most of Iran's oil exports, are now facing higher prices for Iranian crude. The reduced supply has pushed them to explore other oil sources, picking up unsold oil from previous trading cycles. Despite these challenges, the demand for Iranian oil remains strong, though it’s now being met at a higher cost.

Ongoing Evasion Tactics: Ship operators are employing various tactics, such as renaming vessels and turning off transponders, to evade U.S. sanctions. These moves, while reducing scrutiny, highlight the lengths to which operators are going to continue the flow of Iranian oil to China, despite increasing U.S. pressure.

VW Workers Start Walkouts Over Plans to Slash Costs in Germany

Photo by sgcdesignco / Unsplash

Strikes Over Cost-Cutting Measures: Volkswagen workers in Germany have launched walkouts after failed negotiations between labor leaders and management over cost-cutting strategies. The walkouts, aimed at pressuring management, have spread across nearly all of VW's German plants, including the key electric vehicle factory in Saxony. Shares of the company dropped by as much as 1.9%.

Tensions Over Factory Closures and Job Cuts: The dispute centers on management's proposal to close three factories and lay off thousands of workers due to falling demand for electric vehicles, high operational costs, and rising competition from Chinese manufacturers. Union representatives are fiercely opposing the closures, seeking to keep the plants open.

A Major Collective Bargaining Standoff: This is the most significant collective bargaining conflict Volkswagen has faced in recent years. While the company seeks a constructive resolution, union leader Thorsten Gröger has warned that the battle could become one of the toughest in the company's history. In 2018, over 50,000 workers participated in a similar dispute, highlighting the intensity of the current situation.

Volkswagen’s Governance Structure Under Scrutiny: VW’s corporate governance, which gives workers significant influence through representation on the supervisory board, has complicated management’s ability to push through the proposed cuts. Employee representatives hold half of the board seats, with the state of Lower Saxony holding additional power, making unilateral decisions more challenging for the company.

Trump Weaponizing Dollar Seen as a Needless BRICS Provocation

Photo by The Now Time / Unsplash

Trump's Comments Spark Concerns Over Dollar Dominance: President-elect Donald Trump's recent comments warning the BRICS countries against creating a new currency in place of the U.S. dollar have raised concerns among market experts. While the dollar remains dominant globally, Trump's aggressive stance could inadvertently accelerate efforts by emerging markets to reduce reliance on the greenback.

Potential Backfire on Dollar Dominance: Despite the dollar’s current supremacy in global trade and finance, Trump’s comments could have the opposite effect by encouraging BRICS nations to pursue alternative currency arrangements. While the U.S. dollar remains highly liquid and widely used, the increasing pressure from Trump may push countries to seek ways to avoid using the dollar, as seen in past agreements between China, Brazil, and other nations to settle trades in local currencies.

Short-Term Volatility vs. Long-Term Shifts: Trump's social media posts continue to cause market volatility, reminiscent of his first term, where sudden comments often triggered sharp market fluctuations. While experts like Brad Setser view these actions as a sign of U.S. insecurity about the dollar's position, the long-term consequences for the dollar's dominance remain uncertain, with countries like Brazil and China already exploring alternatives.

U.S. Dollar Still Unlikely to Lose Its Dominance: The dollar continues to hold a commanding position, accounting for around 88% of global currency trades. Its role as a haven currency and the strength of the U.S. economy make any serious challenge to its dominance unlikely in the near future. However, Trump’s approach may inadvertently heighten tensions and fuel efforts to diversify away from the greenback, particularly in regions where U.S. policy is increasingly viewed as overbearing.

Latest On Global Markets

US Futures: Futures are pointing lower, with Dow Jones futures down 0.09% and S&P 500 futures dropping 0.15%.

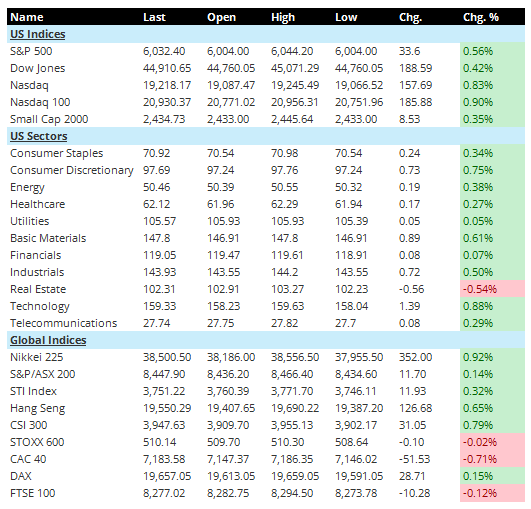

US Indices (Previous): The Nasdaq led the day’s performance, rising 0.83%, followed by Nasdaq 100 with a 0.90% gain. The S&P 500 increased 0.56%, and the Dow Jones gained 0.42%. Small Cap 2000 saw a smaller increase of 0.35%.

US Sectors (Previous): Technology led the sectors, climbing 0.88%, followed by Consumer Discretionary at 0.75% and Basic Materials at 0.61%. Consumer Staples rose 0.34%, and Energy added 0.38%. The only sector to decline was Real Estate, falling -0.54%.

Global Indices: The Nikkei 225 led global indices with a gain of 0.92%, followed by the CSI 300 with a 0.79% rise. The STI Index climbed 0.32%, and the Hang Seng rose 0.65%. The STOXX 600 dropped slightly by -0.02%, while the CAC 40 fell -0.71% and the FTSE 100 declined -0.12%. The DAX saw a modest gain of 0.15%.

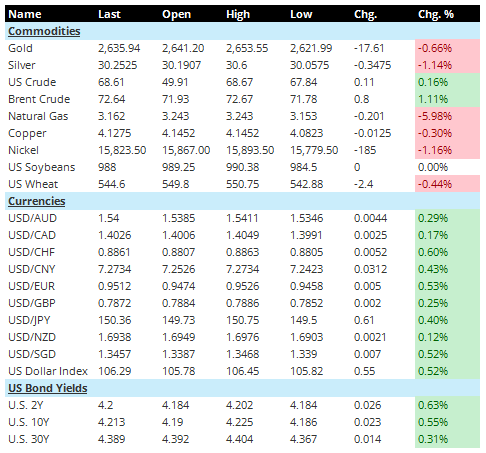

Commodities: Brent Crude saw a notable gain, rising 1.11%, while US Crude increased by 0.16%. However, Natural Gas dropped 5.98%, and Copper fell 0.30%. Gold declined 0.66%, and Silver also decreased 1.14%. Nickel dropped 1.16%, and US Wheat decreased by -0.44%, while US Soybeans remained unchanged.

Currencies: The US Dollar strengthened against several currencies, rising 0.52% on the US Dollar Index. Against the Swiss franc, the dollar increased 0.60%, and it rose 0.43% against the Chinese yuan. The dollar also gained 0.53% against the euro and 0.40% against the Japanese yen. However, the dollar weakened 0.29% against the Australian dollar.

US Bond Yields: Bond yields saw slight increases, with the 2-year yield rising 0.63% to 4.20%, the 10-year yield increasing 0.55% to 4.21%, and the 30-year yield rising 0.31% to 4.39%.

Economic Data & Central Bank Speeches Today

- 9:45 AM: Final value of U.S. Manufacturing PMI for November, estimated at 49, with an initial reading of 48.8.

- 10:00 AM: U.S. October Construction Spending, seasonally adjusted month-on-month annualized rate, estimated at 0.2%, compared to the prior value of 0.1%.

- 10:00 AM: U.S. November ISM Manufacturing Index, estimated at 47.6, up from the previous value of 46.5.

Other Notable News

-

US Proposes Tariffs on Solar Imports: The U.S. Commerce Department issued a preliminary ruling against solar products from Cambodia, Malaysia, Thailand, and Vietnam, proposing tariffs of up to 271% for unfair pricing practices.

-

Bank of Japan Rate Hike Signal: Bank of Japan Governor Kazuo Ueda suggested in an interview with Nikkei that a rate hike may be imminent, as inflation and economic trends align with the central bank's forecasts.

-

South Korea Export Recovery: South Korean exports returned to growth in November, driven by increased demand for semiconductors.

-

French Government Standoff: The French government concluded budget discussions without revising the social security law, according to far-right leader Marine Le Pen. This decision could prompt a no-confidence vote as early as Wednesday.

-

Calls for Further ECB Rate Cuts: ECB board member François Villeroy urged additional rate cuts, anticipating eurozone inflation could reach 2% by early 2025. Fellow board member Yannis Stournaras linked potential U.S. tariff actions to more aggressive rate cuts.

-

Canada-US Border Agreement: Canadian Prime Minister Justin Trudeau met with former President Donald Trump, pledging to consider deploying additional resources and personnel to enhance the US-Canada border.

-

Eurozone Inflation Exceeds Target: Eurozone consumer prices increased by 2.3% year-on-year in November, surpassing the ECB's 2% target. However, the rise is not expected to alter the central bank’s plans for rate cuts.

-

India's Economic Slowdown: India’s economic growth for July-September fell to its lowest level in nearly two years, intensifying calls for the central bank to ease monetary policy.

-

Ukraine Open to Ceasefire: Ukrainian President Volodymyr Zelensky expressed willingness to consider a ceasefire with Russia, contingent on NATO’s commitment to protecting Ukrainian-held territories.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.